Recognizing the Right Moment to Transition

When to break stealth is one of the most critical decisions in the silent launch journey. Stay hidden too long, and you miss growth opportunities; emerge too early, and you waste resources on premature scaling. Based on our silent launch framework, we’ve identified seven concrete signals that indicate your measured, quiet approach is ready for deliberate expansion.

The transition from stealth mode to growth mode requires careful timing. Unlike traditional launches that begin with marketing fanfare, silent launch scaling happens after establishing product-market fit through organic channels. Recognizing these signals prevents the common pitfall of premature public launch that derails many bootstrapped ventures before they gain sustainable traction.

Signal 1: Consistent Organic Growth Without Intervention

The Metric: Month-over-Month User Acquisition

When to break stealth becomes clear when your user growth shows consistent organic patterns. If you’re seeing 15-25% monthly growth without active promotion, your product is finding its audience naturally. This indicates that:

- Your product-led growth engine is working

- Word-of-mouth and referrals are sustaining momentum

- The market is responding to your core value proposition

Actionable Threshold: Three consecutive months of 15%+ organic growth signals readiness for stealth mode exit. Tools like Google Analytics can track these patterns, while our growth strategies category offers deeper analysis frameworks.

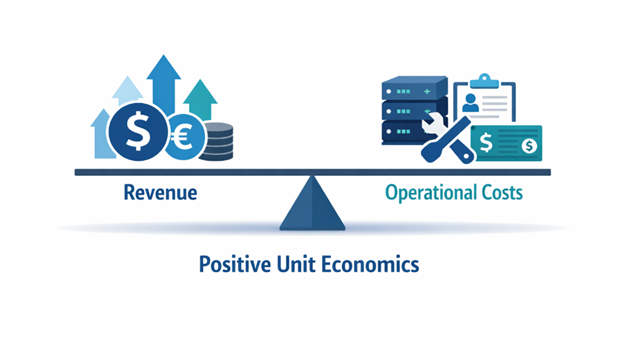

Signal 2: Revenue Covering Operational Costs

The Metric: Positive Unit Economics

Your silent launch scaling should wait until your revenue consistently covers:

- Hosting and infrastructure costs

- Essential tool subscriptions

- Founders’ basic compensation (if applicable)

When you achieve bootstrapped sustainability, where each new customer contributes positively to your bottom line, you’ve built a foundation that can support growth investments.

Key Insight: Profitability before promotion ensures you’re scaling a viable business, not just user numbers. For financial tracking methodologies, Bench Accounting’s small business guides provide excellent frameworks.

Signal 3: Clear User Feedback Patterns Emerging

The Metric: Consistent Feature Requests & Use Cases

During stealth, you should observe patterns in user feedback. When 70%+ of feedback converges on:

- The same feature requests

- Similar use cases

- Consistent workflow improvements

…you’ve identified what your market actually wants. This clarity prevents premature public launch based on assumptions rather than evidence.

Implementation Tip: Create a feedback tagging system in tools like Canny or Notion to categorize and prioritize user input systematically.

Signal 4: Natural Network Effects Activating

The Metric: Viral Coefficient > 0.5

When to break stealth often aligns with network effects kicking in. Measure:

- How many users invite colleagues/peers

- Organic team or group sign-ups

- Multi-user adoption within organizations

A viral coefficient above 0.5 (each user brings 0.5+ additional users) means your product naturally expands its own reach, a powerful foundation for stealth mode exit.

Calculation Method: (Total Invites Sent × Conversion Rate) ÷ Total Users = Viral Coefficient. For deeper analysis, ProductLed’s growth metrics guide offers comprehensive frameworks.

Signal 5: Support & Onboarding Scaling Gracefully

The Metric: Support Volume vs. Resolution Capacity

Before silent launch scaling, ensure your support systems can handle increased volume. Monitor:

- Average response times (should be < 4 hours)

- First-contact resolution rate (aim for > 80%)

- User satisfaction with support interactions

When you can maintain quality support without founder burnout, you’re ready for increased user volume. Consider tools like Crisp or HelpScout for scalable support solutions.

Signal 6: Documented Success Stories Available

The Metric: 3+ Detailed Case Studies

When to break stealth successfully requires social proof. Before emerging, document:

- Quantifiable results (time saved, revenue increased, efficiency gained)

- User testimonials with specific outcomes

- Implementation stories that others can relate to

These become your stealth mode exit marketing assets. For case study templates, our business documentation guides provide practical frameworks.

Signal 7: Clear Next Feature Development Roadmap

The Metric: 6-Month Product Roadmap Confidence

Your final signal for silent launch scaling is product clarity. You should know:

- The next 3-4 feature releases

- How they address validated user needs

- Their expected impact on user retention and growth

This prevents the “what now?” stagnation that often follows initial launch success. Tools like Productboard or Aha! can help structure this planning.

The Transition Framework: From Stealth to Scale

Phase-Based Expansion Strategy

Once you’ve identified 5+ of these signals, implement a gradual stealth mode exit:

Month 1: Increase content marketing (focused on documented use cases)

Month 2: Begin targeted outreach to complementary communities

Month 3: Launch referral program based on existing user behavior

Month 4: Consider limited paid testing in most responsive channels

This measured approach maintains your bootstrapped sustainability while testing scaling assumptions with minimal risk.

Common Transition Mistakes to Avoid

What Premature Scaling Looks Like:

- Hiring before systems exist (adding team without processes)

- Marketing before messaging is proven (spending on unvalidated angles)

- Feature expansion before core stabilization (adding complexity prematurely)

- Channel diversification before mastery (spreading too thin too fast)

Each represents premature public launch behaviors that undermine silent launch advantages. For avoidance strategies, Y Combinator’s scaling guidelines offer valuable counterpoints.

Implementation Checklist: Breaking Stealth Systematically

Pre-Transition Validation (30 Days Before)

- Verify Signal 1: 3+ months organic growth ≥15%

- Confirm Signal 2: Revenue covers 100% operational costs

- Document Signal 6: 3+ detailed success stories

- Finalize Signal 7: Clear 6-month product roadmap

- Prepare scalable systems (support, onboarding, billing)

Transition Execution (Month 1)

- Update website with social proof and case studies

- Begin content series addressing documented user challenges

- Activate referral program based on natural sharing patterns

- Monitor all seven signals weekly for adjustment needs

Conclusion: Timing Your Market Emergence

When to break stealth isn’t a date on a calendar, it’s a convergence of validated signals. By waiting for these seven indicators before silent launch scaling, you ensure that your transition to growth mode builds upon proven foundations rather than hopeful assumptions.

The most successful stealth mode exits happen when the product has essentially already “launched” itself through organic channels. Your public emergence then becomes an acceleration of existing momentum rather than a risky bet on untested markets. This measured approach maintains bootstrapped sustainability while maximizing your chances of successful, sustainable scaling.

For the complete silent launch methodology, revisit our foundational 5-phase silent launch framework, then explore implementation through our pre-launch validation guides.

Transition Planning Question: Which of these seven signals is strongest in your current silent launch? Which needs the most attention before considering your stealth mode exit?

This analysis continues our educational series on measured, sustainable business growth. For more systematic approaches to bootstrapped scaling, explore our complete business strategy collection.

Frequently Asked Questions: When to Break Stealth

Educational Framework & Legal Disclosures

Framework Purpose: This article presents an educational framework for understanding silent launch transitions. It provides methodological understanding, not specific business advice. Always adapt frameworks to your unique context and verify through independent validation.

Timing Variability: Signals and thresholds vary by industry, market conditions, and business model. Use these as guidelines rather than absolute rules, adjusting for your specific circumstances.

Tool Reference Notice: Mention of any software tools (Bench Accounting, Canny, Notion, ProductLed, Crisp, HelpScout, Productboard, Aha!, Y Combinator) is for educational example only, not endorsement or affiliation. Always evaluate tools against your specific needs, budget, and due diligence.

Independent Resource: MarxisSolution is an independent educational resource. We are not affiliated with, endorsed by, or connected to any companies or tools mentioned. All trademarks remain property of their respective owners.