Launching an IT startup is exhilarating, but the financial reality can be sobering. Most founders dramatically underestimate their IT startup expenses, leading to premature cash burn and unnecessary stress. In this comprehensive guide, we’ll show you exactly how to calculate IT startup costs accurately, revealing the frequently overlooked expenses that could make or break your venture.

Why Accurate Cost Calculation Matters

Before we dive into the numbers, understand this: The single biggest reason tech startups fail isn’t competition or bad ideas, it’s running out of money. According to CB Insights, 38% of startups fail due to cash flow problems. How to calculate IT startup costs correctly isn’t just accounting, it’s survival.

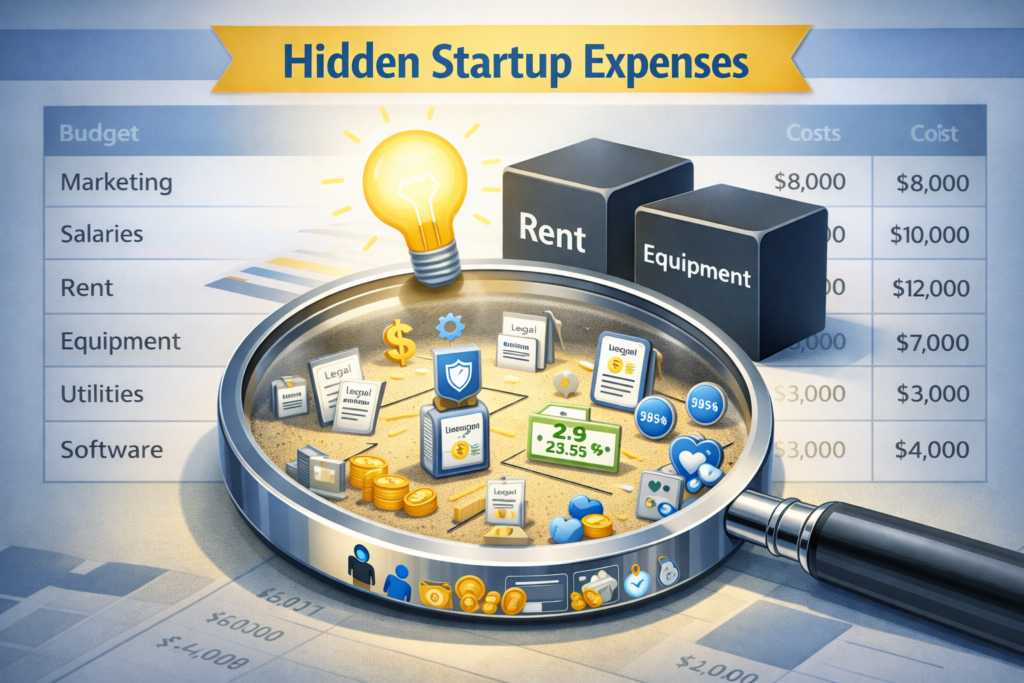

Most founders focus on the obvious expenses: developer salaries, office space, and software licenses. They miss the hidden costs that quietly drain resources month after month. Let’s change that.

The Hidden Categories That Derail Startup Budgets

Infrastructure Costs Beyond the Obvious

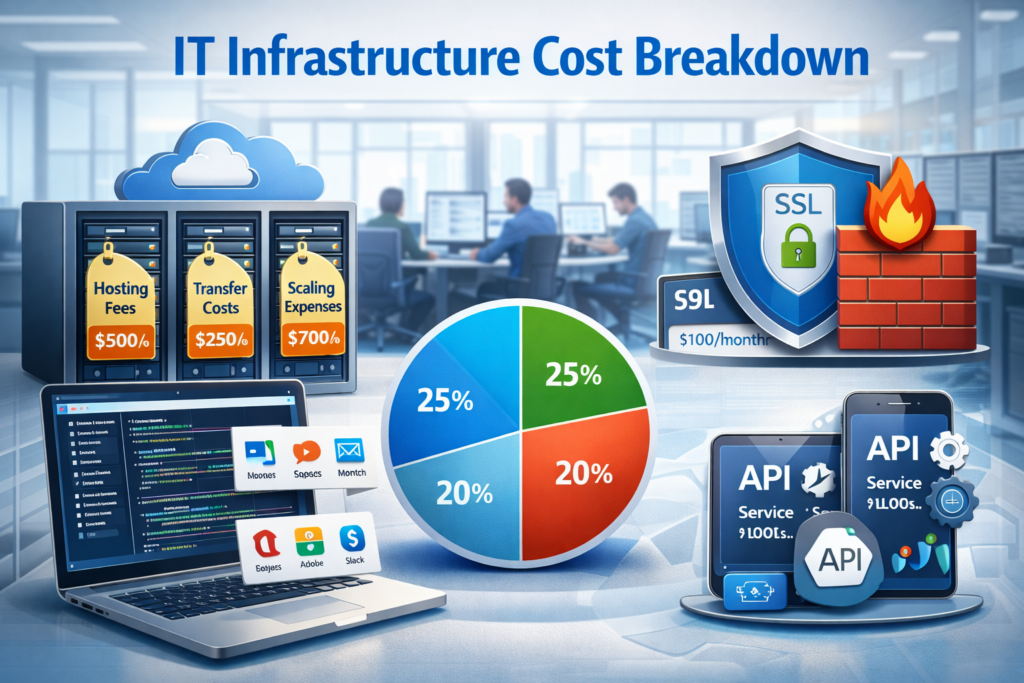

When founders think about infrastructure, they typically consider cloud hosting. But understanding how to calculate IT startup costs requires looking deeper. Cloud expenses can range dramatically based on your architecture, with many startups experiencing “bill shock” when they scale. The real expense isn’t just the base hosting, it’s the data transfer fees, additional services, and scaling costs that accumulate.

Then there’s your development stack. Beyond the core tools, there are integrations, premium plugins, and collaboration platforms that teams genuinely need to work efficiently. Each “small” subscription adds up, and many are priced per user, meaning costs grow with your team.

The most substantial infrastructure cost? Your technical team. Beyond salaries, there are recruitment fees (often 15-25% of annual

), onboarding costs, and the equipment they need to be productive. A comprehensive startup budget planning approach accounts for the total employee cost, not just the salary number.

Operational Expenses That Sneak Up on You

Legal and compliance costs represent one of the biggest blind spots for technical founders. Incorporation is just the beginning. You need terms of service, privacy policies, compliance with regulations like GDPR or CCPA, and ongoing legal consultation. These aren’t one-time expenses but recurring necessities of doing business.

Similarly, accounting often gets minimized until tax season arrives. Proper bookkeeping software, CPA services, and tax preparation all cost money but save you from much larger problems down the road.

Insurance represents another often-underestimated category. Beyond basic business insurance, tech startups need cyber security insurance, professional liability coverage, and potentially directors and officers’ insurance if you take funding. These aren’t optional in today’s landscape, they’re essentials.

The Growth Budget That Grows Without Results

Digital marketing represents a category where budgets can balloon without corresponding results. The tools alone; SEO platforms, analytics software, email marketing systems can cost thousands monthly. Then you add actual advertising spend, which can easily reach five figures for competitive markets.

Content creation has evolved from “just blog posts” to comprehensive strategies requiring video production, graphic design, and potentially agency support. Quality content that actually drives growth requires investment.

Customer acquisition costs deserve particular attention in your technology expense calculation. Many founders use industry averages, but your specific market, product, and competition will determine your actual costs. Underestimating this can mean running out of money before achieving product-market fit.

The Truly Overlooked Expenses

Here’s where most technical founders get blindsided. These categories rarely appear on initial budgets but consistently impact cash flow:

Payment processing seems small at 2.9% + $0.30 per transaction, but as revenue grows, these fees become substantial. International transactions, chargebacks, and premium features add to the total.

Employee benefits represent 25-40% on top of base salary in many markets. Health insurance, retirement contributions, continuing education, and wellness programs are expected benefits that attract talent.

Recruitment costs extend far beyond job board fees. The time cost of interviewing, background checks, onboarding software, and potential recruiter fees make each hire a significant investment.

Cybersecurity has moved from “nice to have” to mandatory. SSL certificates, security audits, employee training, and monitoring services protect not just your data but your reputation.

Backup and disaster recovery often gets postponed until it’s too late. Offsite backups, recovery planning, and business continuity measures seem expensive until you need them.

Third-party API services represent a modern expense many don’t anticipate. Mapping services, email validation, SMS notifications, and other integrations often charge based on usage, creating unpredictable costs.

Practical Framework for Realistic Financial Planning

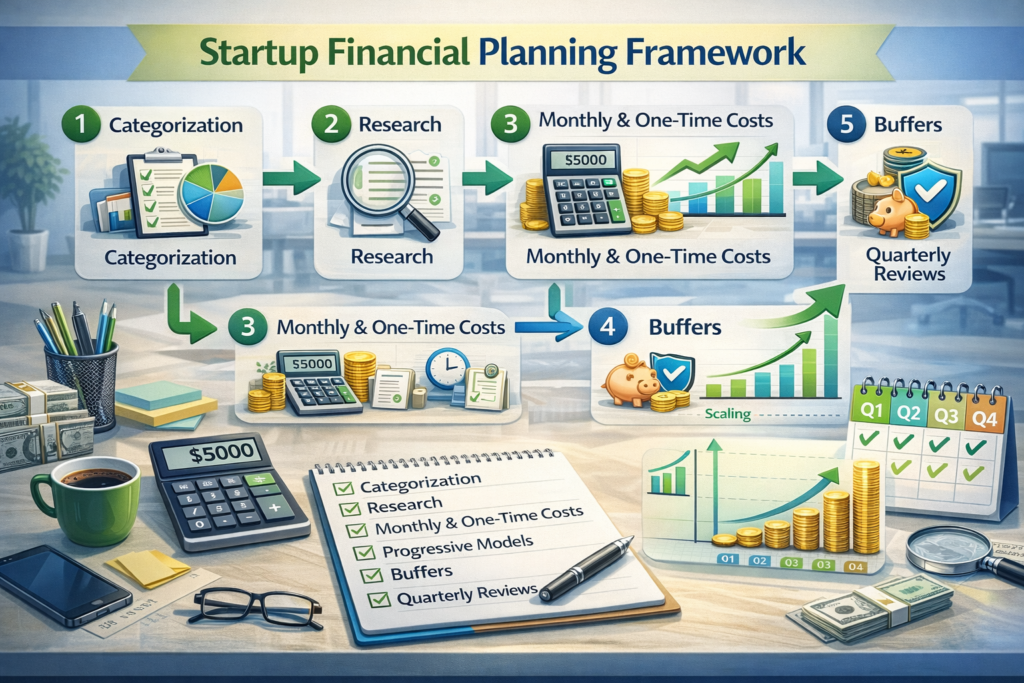

Now that we understand the full landscape of expenses, here’s your actionable framework:

Step 1: Categorize Broadly, Then Drill Down

Start with major categories (infrastructure, operations, growth, team) then identify specific expenses within each. Use standard budgeting templates to ensure nothing slips through.

Step 2: Research Your Specific Context

Generic benchmarks help, but your startup financial planning needs to reflect your specific location, industry, and business model. Research local salaries, regional compliance costs, and market-specific marketing expenses.

Step 3: Calculate Both Monthly and One-Time Costs

Separate recurring expenses from one-time setup costs. This distinction matters for cash flow planning and funding requirements.

Step 4: Build Progressive Models

Your costs at 10 users differ from 100 or 1,000 users. Build models that show how expenses scale with growth, particularly for usage-based services.

Step 5: Include Substantial Buffers

The only certainty in startups is uncertainty. Include buffers for unexpected expenses, market changes, and slower-than-anticipated growth.

Step 6: Implement Quarterly Reviews

Your financial model is a living document. Quarterly reviews allow you to adjust based on actual experience and changing circumstances.

Common Calculation Mistakes and How to Avoid Them

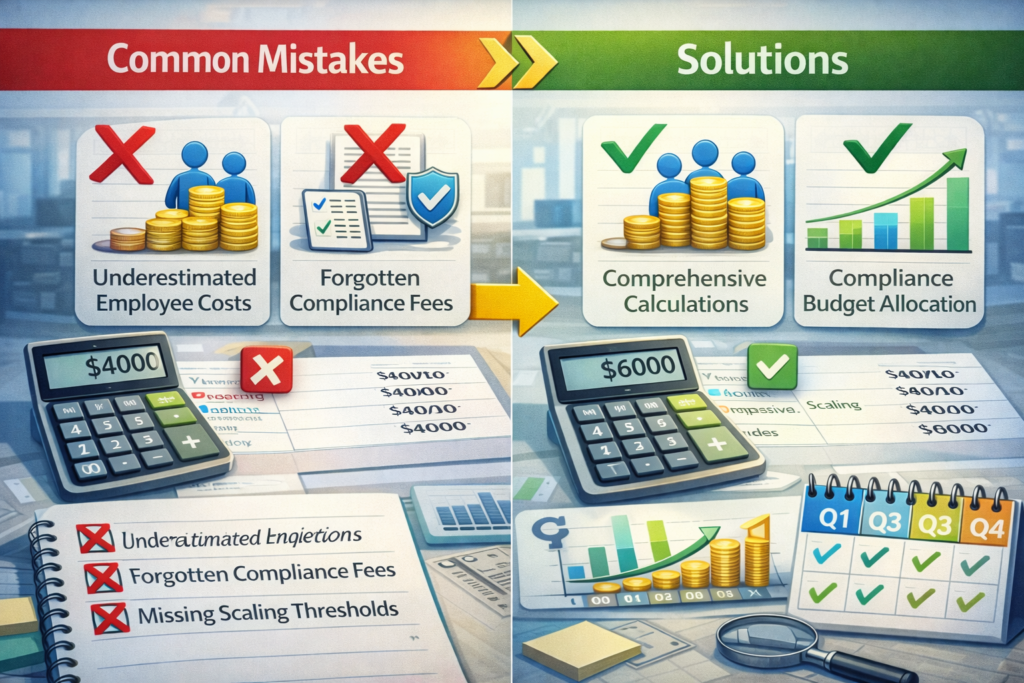

The Employee Cost Underestimation

Founders often budget for salary alone, missing benefits, taxes, equipment, and workspace. The total cost typically runs 1.3-1.5 times base salary.

Solution: Use comprehensive employee cost calculators and include all associated expenses in your models.

The Scaling Oversight

Many costs don’t scale linearly. Some expenses jump at certain thresholds (user counts, data volumes, team size).

Solution: Identify these threshold points in all your services and model the jumps accordingly.

The Compliance Creep

New regulations emerge constantly, particularly in tech. GDPR wasn’t on anyone’s radar a few years ago, now it’s essential.

Solution: Allocate a compliance research and implementation budget, and stay informed about regulatory trends in your space.

The “It’s Free” Trap

Free tiers and trials expire. Founders build reliance on tools that suddenly become expensive.

Solution: Calendar all trial expirations and have a plan (and budget) for when free becomes paid.

Actionable Next Steps for Founders

Understanding how to calculate IT startup costs is theoretical until applied. Here’s your seven-day action plan:

Days 1-2: Document every current and anticipated expense using a thorough expense categorization framework.

Day 3: Research realistic numbers for your specific context (location, industry, stage)

Day 4: Build your 12-month financial model with monthly and annual views

Day 5: Stress-test your model with “what-if” scenarios (slower growth, higher costs)

Day 6: Identify your three biggest cost risks and create mitigation plans

Day 7: Schedule your first quarterly financial review

Key Principles for Sustainable Financial Planning

- Visibility Prevents Surprises – What gets measured gets managed. Full visibility into expenses prevents unexpected shortfalls.

- Context Matters More Than Averages – Your specific situation determines your actual costs more than industry averages.

- Regular Review Creates Resilience – Quarterly financial check-ins allow course correction before problems become crises.

- Buffers Are Strategic, Not Wasteful – Contingency funds represent prudent planning, not poor estimation.

- Tools Enable Accuracy – Leverage calculators, templates, and expert resources to improve your estimates.

Conclusion: From Guessing to Strategic Planning

Mastering how to calculate IT startup costs transforms financial planning from a guessing game into a strategic advantage. By accounting for the full spectrum of expenses, not just the obvious ones, you build a foundation for sustainable growth.

The difference between startups that survive and those that become statistics often comes down to financial foresight. Seeing the complete expense picture allows for better decisions, smarter prioritization, and ultimately, greater chances of success.

Frequently Asked Questions: Calculating IT Startup Costs

Disclaimer

The information provided in this article is for educational purposes only and does not constitute financial or professional advice. Financial figures and estimates are based on industry averages at the time of publication and may not reflect actual costs for your specific situation. Always consult with qualified professionals before making financial decisions. The author and publisher are not liable for any decisions made based on this content. Results may vary based on individual circumstances.